Fiscal Responsibility Bill, 2018

Holding the Government Accountable

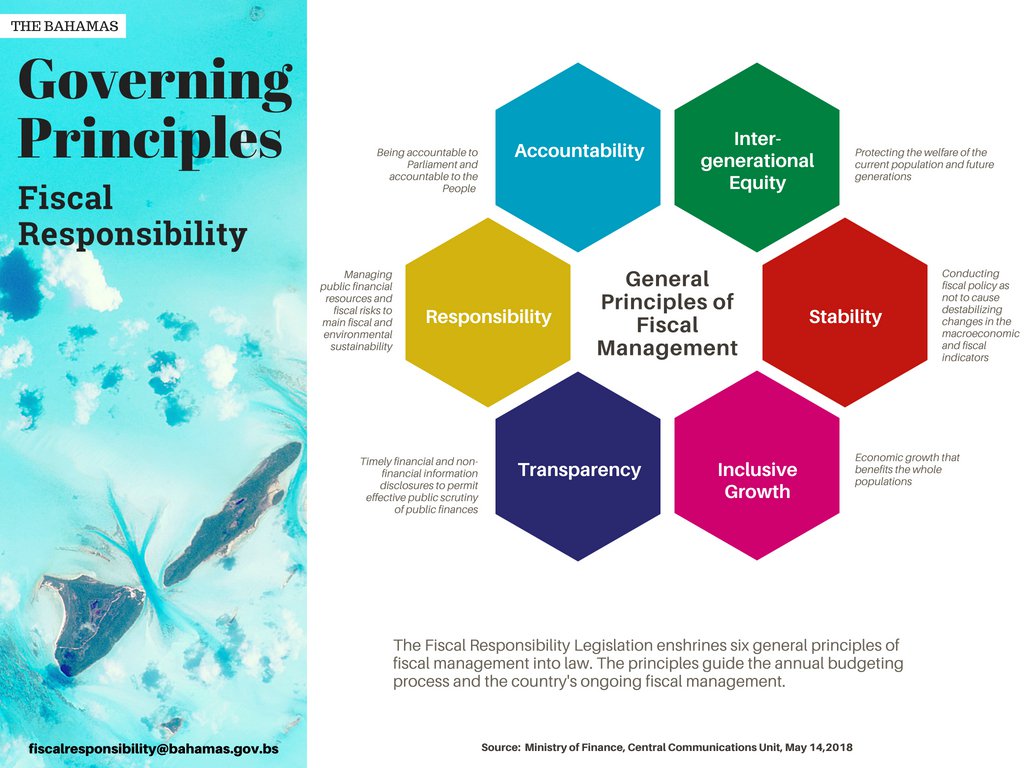

The Government tabled the Fiscal Responsibility Bill, 2018, with plans for the new law to take effect during the fiscal year. This important piece of legislation will reshape the culture of public accountability, by enabling more Parliamentary and public scrutiny of the fiscal management and performance of the Government. The law establishes six general principles of responsible fiscal management that the Government must live by when it prepares and implements the national budget.

5 Things You Need to Know

Things will be different after the Fiscal Responsibility Bill, 2018 is passed. If the government is irresponsible with public finances it will not simply be against standards of good governance, it will also be against the law.

Fiscal Responsibility Council

With the new Bill, civil society will be given legal powers of oversight through a Fiscal Responsibility Council. Five professionals with specific expertise in law, business, economics, accounting, and finance will be independently selected by nongovernmental stakeholders.

Fiscal Balance

The law will force the Government to live within its means. The Government has three years to reduce its deficit. From FY2020/21 onwards, the deficit can be no more than 0.5 per cent of GDP.

Debt Limit

The law will limit government debt to a maximum of 50 per cent of GDP.

Spending Cap

The law will cap government spending so that it cannot grow faster than the economy’s overall growth rate. The average long-run growth in nominal GDP is currently 3 per cent which takes into account the historical and projected path.

Transparency

The Government will have to produce new fiscal reports throughout the year for public and Parliamentary scrutiny. These include a Fiscal Strategy Report, Fiscal Adjustment Plan, and a Pre-election Economic and Fiscal Update.

"Our Government made a commitment to the Bahamian people that we would enshrine fiscal discipline as a core element of our transformative growth agenda. The stringent fiscal requirements of this legislation are groundbreaking in the affairs of our nation but are necessary to ensure that no Government, including our own, ever repeats the disastrous fiscal experience of the previous administration."

The budget website is inspired by a worldwide movement towards citizens budgets. Presented by the Ministry of Finance, it is a visual, interactive and less-technical version of the annual budget that promotes accessibility, inclusion, transparency and accountability.

Government Revenue Continues to Rebound

May 24, 2022

Ministry of Finance Releases First Monthly Fiscal Report

March 21, 2022

Government Revenue Continues to Rebound

Feb. 3, 2022