A number of tax relief measures are included in the Budget to provide assistance to citizens and encourage economic activity by making the import of certain items relatively cheaper. These include duty reductions on frequently imported items worth $28 million in government revenue.Generally speaking, these reductions the focus on educational supplies and equipment, and household appliances and goods.

Frequently Imported Items Made Duty-Free

The Budget includes duty reductions on household goods, school supplies and a number of other frequently imported items.

Duty Reductions

VAT-Free Utilities

Temporary Measure Made Permanent

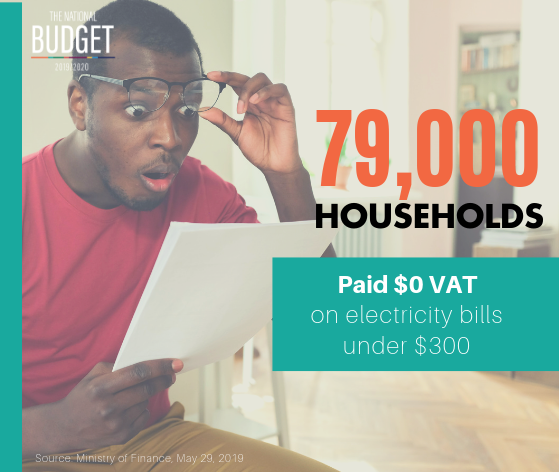

Last fiscal year, the Government increased the threshold for VAT zero-rating on Light Bills from those under $200 to those under $300. It was approved as a temporary measure that was to expire at the end of June.

The higher ceiling has been made permanent, and customers will continue to enjoy VAT-Free electricity bills under $300. Water Bills under $50 per billing cycle will also continue to be VAT-Free for consumers.

Other Tax Cuts

Environmental Protection and Advancement

To advance the Government's commitment to environmental sustainability, several tax measures have been customised to not only protect the environment, but also to increase environmental awareness across all islands.

Customs Duty Reductions

In strategizing our revenue efforts, we are cognizant to consider both the vulnerabilities in our country and the citizens that are most affected by these vulnerabilities, as well as the necessary action that will garner the resources we require. Though striking a balance between the two can prove challenging, at times, we are, and will remain committed to putting Bahamians first as we work to better this country."

The budget website is inspired by a worldwide movement towards citizens budgets. Presented by the Ministry of Finance, it is a visual, interactive and less-technical version of the annual budget that promotes accessibility, inclusion, transparency and accountability.

Government Revenue Continues to Rebound

May 24, 2022

Ministry of Finance Releases First Monthly Fiscal Report

March 21, 2022

Government Revenue Continues to Rebound

Feb. 3, 2022