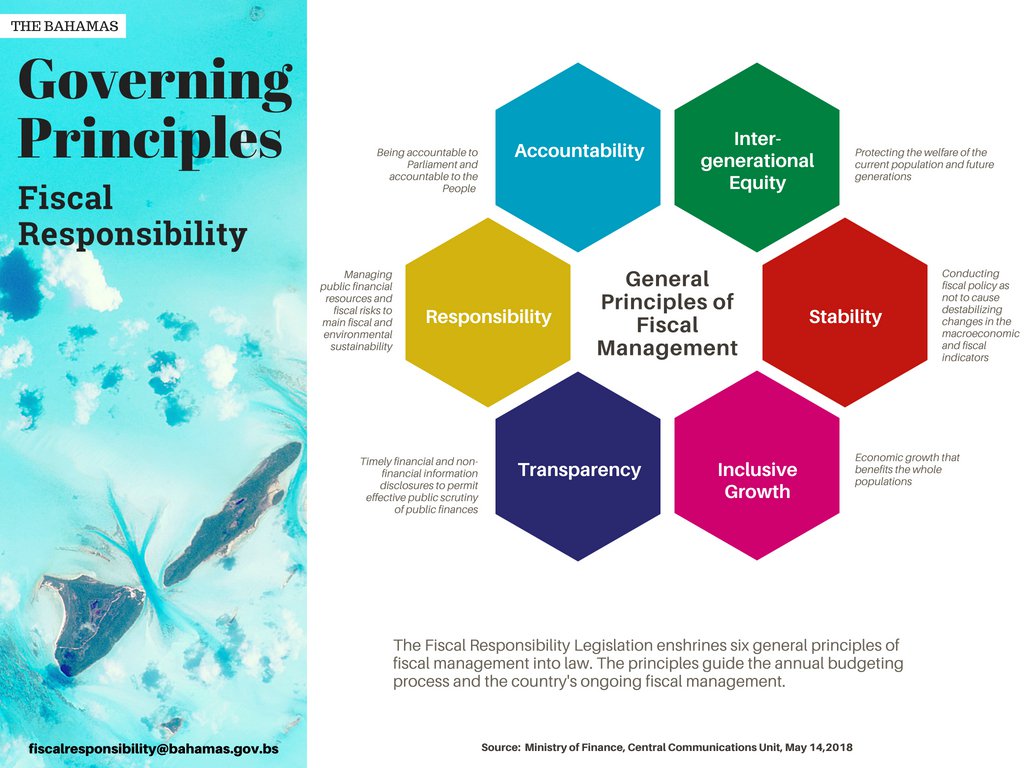

The 2019/20 Budget is the first budget presented since the passage of the Fiscal Responsibility Act, 2018. This important piece of legislation reshapes the culture of public accountability, by enabling more Parliamentary and public scrutiny of the fiscal management and performance of the Government. The law establishes six general principles of responsible fiscal management and specific fiscal targets that the Government must live by when it prepares and implements the national budget.

Fiscal Targets

The overarching strategic goal of the legislation is to achieve specific fiscal objectives with respect to the deficit, government debt and growth rates in recurrent expenditure

DEFICIT TARGET

The law will force the Government to live within its means

The FRA requires the Government to gradually reduce its deficit so that from FY2020/21 onwards, the deficit can be no more than 0.5 per cent of GDP.

DEBT LIMIT

The law will lower debt to sustainable long-term levels

The FRA requires the Government to limit government debt to a maximum of 50 per cent of GDP. The Government's Fiscal Strategy factors in annual improvements with a view to reaching the target in 2024/25.

SPENDING CAP

The law will keep spending in line with the economy’s overall growth rate

The FRA requires the Government to make sure the growth in recurrent expenditure does not exceed the long run growth in nominal GDP, which currently averages some 2.3% (December, 2018).

"Our Government made a commitment to the Bahamian people that we would enshrine fiscal discipline as a core element of our transformative growth agenda. The stringent fiscal requirements of this legislation are not only groundbreaking in terms of transforming the management of our country's fiscal affairs, but they are necessary to ensure that no Government, including our own, ever repeats the disastrous fiscal performance of previous administrations."

Fiscal Responsibilty Council

Start date set for July 1, 2019

The Fiscal Responsibility Act also mandates the establishment of a Fiscal Responsibility Council, which is an independent, civil society body, comprised of five members with legal, business, economic, accounting, and financial backgrounds, respectively. These members are nominated by the Bahamas Bar Association, the Bahamas Chamber of Commerce and Employers Confederation, the University of The Bahamas, the Bahamas Institute of Chartered Accountants, and the Chartered Financial Analyst Society of The Bahamas.

ROLE OF THE COUNCIL

The core role of the Council is to foster budgetary discipline by independently evaluating the Government’s compliance with the rules and principles set out in the Act, including the general principles, fiscal responsibility principles and the fiscal objectives.

The Council is expected to review and assess the Government’s Fiscal Strategy Report, the Mid-Year Review, the Annual Budget, and the Government’s audited annual accounts.

The thorough and complete assessment of each of these documents will serve to promote the Government’s adherence to sound fiscal decisions that take into account the economic impact they will have on the economy.

INDEPENDENCE OF THE COUNCIL

The budget website is inspired by a worldwide movement towards citizens budgets. Presented by the Ministry of Finance, it is a visual, interactive and less-technical version of the annual budget that promotes accessibility, inclusion, transparency and accountability.

Government Revenue Continues to Rebound

May 24, 2022

Ministry of Finance Releases First Monthly Fiscal Report

March 21, 2022

Government Revenue Continues to Rebound

Feb. 3, 2022